Status of Power Retailing in the Middle East

Retailing in the Middle East has proved profitable for many brands. Consumers, regionally, have wanted, for so long, a destination store where they can find multiple offerings rather than a specific brand’s store where consumers need to go from store to store to find what they are looking for. The concept of Power Retailing has come from the inherent need of consumers looking for comfortable shopping, a store where consumers can find what they are looking for, across brands, and solutions.

The GCC retail sector has continued to develop and continues to be a key driver in the economies of GCCs. Power Retailers have been actively developing their presence and offerings in GCC due to many factors, such as high income per capita, active tourism, and the presence of malls-chain that have offered to consumers an exciting and pleasant experience. The numerous numbers of malls, hypermarkets, and destination areas have helped power retailers to be closer to their customers, and therefore, make sure they offer several options that would allow the customer to make an instant purchase in a world where competitiveness drives businesses.

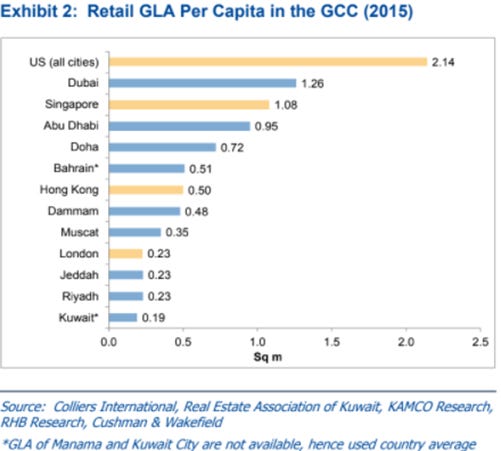

In UAE, as per the GCC Retail Industry report of 2017, Retail GLA per capita places Dubai in second place after U.S (All cities) with 1.2sq/m per capita (see Exhibit 1). This would go, of course, as part of the country’s plan towards developing the non-oil economy, which allows more exchange of trade, services, and products to drive economic growth.

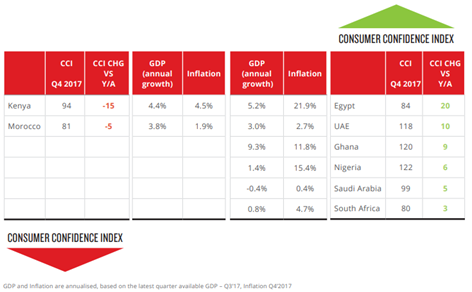

In Saudi Arabia and the United Arab Emirates, however, indicators will take longer to normalize following the implementation of the value-added tax (VAT) and the sugar tax. Taxation is new to consumers in these markets, and the compounded effect of both price changes will affect consumer spending, shopping dynamics, and coping mechanisms for the next 12 to 18 months as consumers rebalance their baskets. A growth of 10 points in UAE has been noticed although such a measure as VAT was announced by the end of 2017, similarly, KSA has 5 points of growth on the consumer confidence index as per Nielsen Q4 2017 Consumer Confidence Report. (see Exhibit 3)

Moreover, these retailer’s advantages don’t come with no-cost. The competition has increased among power retailers and consumers now have more options than ever before. The digital adoption of consumers around the Middle East has drastically increased, allowing them to check and compare offerings from multiple sources at on click of a button. As much as consumers’ awareness of comparison techniques has developed, retailers needed to change their mindset to cope with the change in the trend, therefore, we can notice several improvements in the retailer’s business models, such as;

· Introduction of Loyalty Programs:

Retailers want to keep the consumer lifecycle long, retention rate as high, and basket value as big as before so they don’t lose customers to competition. The loyalty program’s introduction has allowed retailers to reach existing customers, maximize data analytics, and compete in the digital world. These loyalty programs come with a cost that impacts their bottom line but are considered as marketing investments.

· Wider Product Line-up and Brand offering

As consumers became more price-conscious, retailers had to tackle multiple income-level customers by offering multiple products of the same nature. For instance, mobile phone brand expansion on their shelves has expanded from famous brands to mid and low-value brands, helping customers with a limited budget to be able to shop at their store. To leverage the offer, bundling, and cross-selling become the new value factor to the sales talk which offers retailers an added margin, and offer customers an added value to their purchase.

· Warranty, Service, and Follow-ups

When it comes to consumer electronics in general, consumers are conscious about warranty status. Some retailers have leverage on this need by introducing 3 years warranty and in some cases, a replacement warranty for personal-fail of using the device, such as breaking the mobile phone in-deliberately.

As much as Retailing in the Middle East has matured, customers’ expectations are growing drastically, this expected growth could happen due to several reasons, however, the influence from major global players is impacting the way the customers expect retailers and brands to treat and understand them.

This influence has placed enormous pressure and stress on retailers and channels to stay competitive as globalization emerges in the region touching their customers. I could list a few factors that play the main role in responding to the new customer’s expectations that the retailers face:

· Competition

As stated in the intro, malls' numbers are increasing, opportunities for retailers are increasing, and therefore, competition increases in return. You can find several players in the same mall, precisely, on the same floor. Accessibility to competitors has been stressed on retailers now where customers are 2 steps away from the competitors.

· Comparison

UAE’s mobile phone penetration rises to 228% Mobile phone usage in the UAE increased to 228.3 phones per 100 people in the first quarter of 2017, according to statistics issued by the Telecommunications Regulatory Authority. As the number can self-explain, consumers have access to the internet at their fingertips which allows them the digital accessibility to compare offerings. In many scenarios, and due to postal facilities by UAE and KSA, consumers rather shop internationally as prices or services are more competitive, or sometimes, faster in delivery or support. Which created another paradox for retailers.

· Online Retailing

Why did Amazon acquire Souq.com? The answer could unlock Amazon's view on Middle East e-retailing potentiality. The easy answer is that acquiring customers takes time, effort, investment, patience, and an incremental mindset to adapt strategies. Also, it takes time to understand the market, and customer behavior, and to gain their trust. This has placed a pressing issue on retailers as customers have developed higher trust in buying online from a global player with a high and trusted reputation such as Amazon. Most retailers in UAE and KSA are trying to develop their online presence in the hope of retaining their customers, however, competing on the digital level requires a specialty-trained workforce, major investment, and long-term ROI vision.

To tackle the above-discussed pressing issues on retailers, some major shift is needed, by looking at the competition landscape, customers demand and expectation, and trade environment, simple yet effective measures can be introduced to keep up with competition and changing trends. Below are few actions to be considered, which some retailers have already started to roll out;

1. The Issue of Declining Margins

Declining margins are due to several reasons; however, the main reason remains as price-conscious customers who seek better deals. However, Retailers can relook at their bottom-line strategy, and restructure their business model on an added-value element. As consumers seek a better deal, a noticeable trend from consumers of leaning towards bundled items where the value perceived is much higher. When retailers think of cross-brand bundling, their bottom line could go higher while the price goes lower. By basically thinking economies-of-scale, it is no longer a product sold to customers, rather, it’s a set of bundled products sold to many customers.

2. The Issue of Workforce Skills

Human capital remains the #1 driving force of every retailer. A trained staff is required to stay relevant in the competing environment. As the retailer’s workforce is the first touchpoint with customers, and as the customers become generally more aware of the product/brand they want, the staff needs to prove understanding and knowledge of customer needs and expectations. Focus on training, skills enhancement, and compensations are key actions to win the touchpoint paradox.

3. After-sales Customer Service/Support

Online retailers are obsessed with customer service, offering 24/7 hotline, pick-up and replace, and other services to satisfy their customer base. Souq.com for instance has launched Helpbit.com, a platform dedicated to helping and servicing customers around the region. While physical retailers have developed a similar approach, still CRM adoption is minimal in comparison to the data the retailers are acquiring daily. The conventional approach to service is no longer relevant, waiting for an angry customer to walk in with a device problem that we will solve is no longer the case. The development of a 360 CRM approach based on data analytics that aims fundamentally to increase customer retention, and then increase customer satisfaction in a timely and instant manner is important to compete.

During our listing, we’ve mentioned several online retailers many times, and many have the assumption that the end of what so-called ‘offline retail’ or what we know as simple as a retail store, would be very near. Regardless of this assumption, retailers have been growing YoY on the basis of profit and presence. More new stores are opening every month, and more competitors are on board now, although a portion of consumers have completely shifted online, needless to say, a considerable number of consumers still rather visit the store first, from my experience in retail and marketing, I attribute that to several factors, such as customer experience, access to digital payments, service and accountability;

· Product/Customer Experience

Although consumers become sensitive to prices, however, they want to experience what you have to offer. Many consumer electronics retail stores have noticed an increase in footfall once OLED TVs, VR gadgets, and High Res Audio Source devices. Consumers want to try, they want to live the experience that the brand is promising them to have. This important element of the consumer journey still lacking at the digital level.

· Access to Digital Payments or Banking

Unlike matured banking countries, many Middle Eastern consumers trust cash more, and therefore, their accessibility to digital payment via bank card is very limited. Some retailers (or e-retailers) have offered Cash-on-Delivery service. Customers want to buy your offering, however, they want to pay for it on their way. In many countries, cash payment is still in business. Going to the nearby store and purchasing a mobile phone a camera, or even a data projector is still in trend and customers do buy the product with an exchange of paper cash. As per WSJ, the below findings have been identified:

Cash on delivery is not going anywhere. Despite the region’s high e-commerce adoption, 80% of online transactions are still made with cash-on-delivery.

About a quarter of internet users have a credit card in the region. So cash is still king.

However, card issuance is growing at 40% each year. (see Exhibit 4)

The cost of cash on delivery for merchants can range from $10 to $30 per transaction due to high product return rates, re-stocking and re-shelving of undelivered products, cash-handling costs, thefts, and customers abandoning payments on delivery.

The main reason people shop online is competitive pricing and getting a good deal. Some 66% of people surveyed cited this as the driving factor.

Souq.com is the number one visited e-commerce site in the United Arab Emirates, Saudi, and Egypt based on Alexa Rankings, while Amazon is number one in Kuwait.

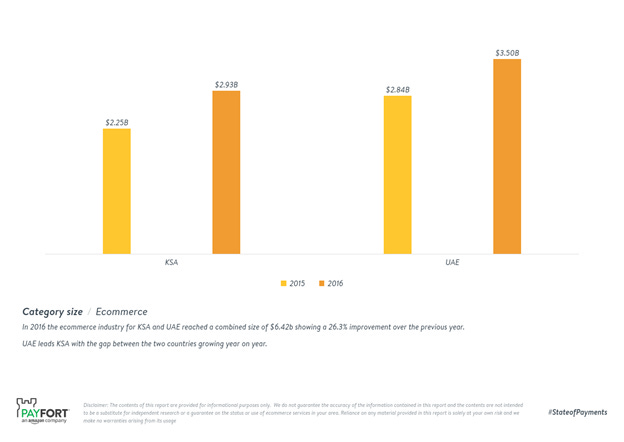

As retailers try to compete on digital platforms, the Amazon news of acquiring Souq.com still echoes today. The move has uncovered the potential of this region to the global players. However, the evolving competition locally, such as Noon.com has emerged in the favor of the consumers, other players are investing heavily in digital commerce, such as Wadi.com and Namshi.com. Having Amazon title a local company such as Souq.com has increased consumer trust in online buying. Amazon has developed globally as a trust-worthy online shop by ensuring that the customer comes first (rather than putting their marketplace’s sellers first) which has built a trust connection with consumers. Arab consumers and the region consumers are not any different from other consumers globally, they all want a trusted transaction in exchange for their money. As Per PayFort, an acquired company by Amazon, The Middle East e-commerce market is set to double to more than $69bn by 2020. The UAE’s $27 billion e-commerce market and the Kingdom of Saudi Arabia’s $22 billion markets, will be the two largest markets dominating the region by 2020, PayFort’s 2016 State of Payments report found. (see Exhibit 5)

When it comes to power retailing, the concept of offering multi-brands to one customer is the generic meaning of the term. However, an emerging type of power retailer has started to see lights around KSA and UAE such as EMPOWER Retail Stores that offer customers high-tech IT Equipment, the added value is that some of their products can be customized to suit the needs of the customers. As customers became more tech-savvy, the unique needs of some customer segments have evolved to find more High-Tec devices, which have allowed many B2B brands to satisfy the needs of customers via retail shops, adapting their business model to be fixable on both B2B and B2C levels. This would allow much of the system integration products to be sold on a retail level rather than a stand-alone and only for mega to small-medium projects. For instance, the same IT manager who is looking for a total office solution might now solely source the office multifunction printer from one store in a mall. Another example of a marketing manager looking for a CRM system stand-alone, and now he can find it on the shelf in some store in a mall. This accessibility to High-tech items has increased sales by taking another stance on flexible business models.

For Example, Sharaf DG’s leading service, DG+ is a system integration store (actual store) that helps customers who require Audi/Visual High-Tec products or support. Tackling another customer segment was important to satisfy the changing needs of customers, and the changing trend of how people procure their items.

However, conducting such a flexible business model requires patience. As much as a tempting purchase of a High-Tech multitasking printer of 10 thousand dirhams could sound, however, the frequency of transaction lifecycle is rather long, and therefore the brand and retailers need to tackle their bottom-line forecast through a critical study of demand vs. supply, product lineup as not to sell a product, rather a solution (a multitasking printer with a cloud storage solution that can be linked to Employee Performance Analytics Software, for instance) offered, and location!

CONCLUSION:

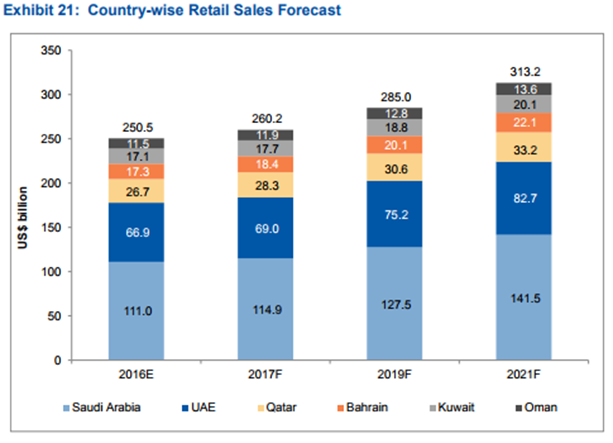

UAE Retail Landscape is performing growth, it is estimated, as per the Retail Industry Report (see Exhibit below) to hit 82.7 billion USD in 2021 with a GACR of 7%. As the country introduces AI Strategy and several Blockchain enhancements to its trade policies, retailing expects to grow, both on the Online and Offline level, as consumers become more tech-savvy, the competition will increase, which allows Retailers to create more creative offerings across the country. With the number of destination malls expected to open in UAE, tourism increases and is forecasted to hit 250+ billion USD by 2027 would open new opportunity windows for more retailers, and more expansions for the current ones. Understanding the opportunity of leveraging on the bottom line can be inspired by the country’s forecasted GPD per capita which will go around 41,182 USD of 2% CAGR.

KSA Retail Landscape, on the other hand, has introduced game-changing regulations, introducing VAT, and Saudization has not gone unnoticed. However, the Consumer Confidence Index has, as per Thomson Reuters, didn’t have much of a big impact. By the end of 2017, the average CCI had evolved between 55 points to 6 points, compared with 2016, around a minor decrease. However, this doesn’t look like it is impacting Saudi local consumers, as GDP per capita is estimated to hit 22,636 USD by 2021 of 2% CAGR.

This will unlock the market potential for more retailers to join, as of now, few key retailers are dominating the market, but the Crown Prince’s vision is to tackle global players which he demonstrated in his latest trip to U.S to visit key tech players and seeking investment flow in KSA.

Retailers need to quickly understand the future and prepare for it, offering customers the same products with a price-factor change and good service won’t be all that they need. A link between their products is required, a cross-promotion that would allow consumers to make sense of their dollars spent at that particular store, this would keep competitiveness healthy for both retailers and consumers benefit.

Expansion is also necessary, some retailers have already started to expand to other countries in the region, such as Egypt, Lebanon, etc. This move will allow retailers to gain a first-entry advantage and the opportunity to build the retailer’s brand in that market before competitors. Countries like Egypt and Lebanon have shown a great development of malls and destination centers which have allowed some UAE-based retailers to tackle the opportunity and leverage on the experiences it had in the UAE. Another Hypermarket brand that has established its name strongly in UAE, has expanded in Egypt, however, adapting the key cultural elements, and offering suitable products/solutions to local consumers, was the key for them to success.

I wrote this article back in 2020. I’m resharing it here for reach and archiving purposes.

considering the increasing digital adoption mentioned in the article, how do you foresee emerging technologies can shape the future of retail in the MENA?

I was thoroughly impressed with the clarity of your writing and the depth of analysis presented in this article. The use of data to support key points was particularly effective. Your article is a commendable piece of work and I appreciate the effort you've put into it. Well done.